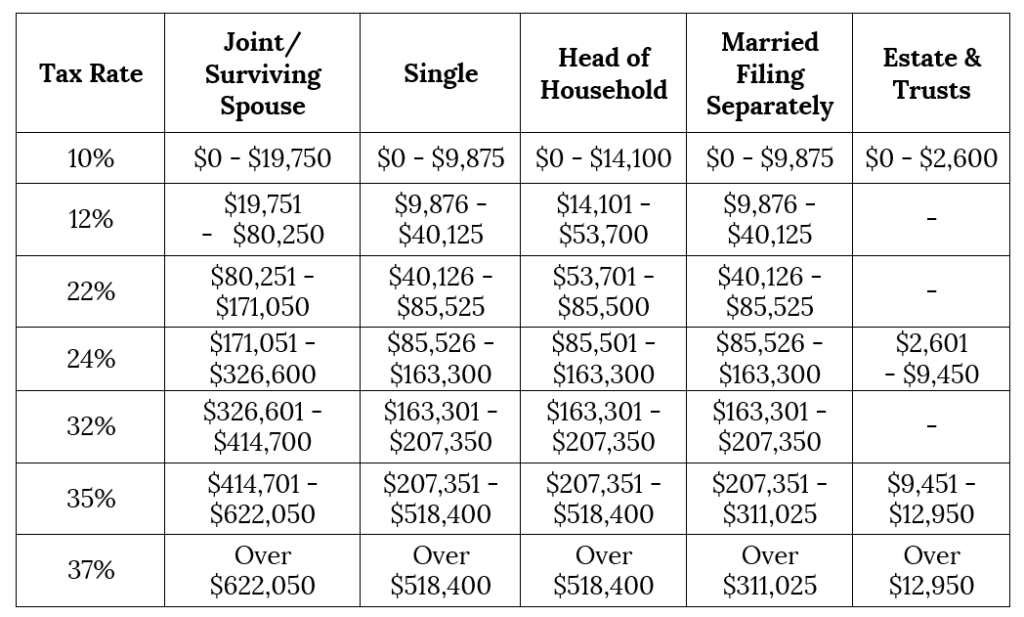

There are four complete sets of tax brackets for different filing types, each with different bracket widths. This will result in lower Federal income taxes for those whose salaries haven't kept pace with inflation. With typical inflation adjustments a mere 1-2%, the 2023 Federal income tax brackets have been adjusted for inflation by as much as 10.5%. With inflation at historical highs, the IRS has adjusted Federal tax brackets significantly to account for inflation. This page explains how these tax brackets work, and includes a Federal income tax calculator for estimating your tax liability.įederal Income Tax Brackets Indexed for Inflation The Federal Income Tax consists of seven marginal tax brackets, ranging from a low of 10% to a high of 39.6%.

Federal income tax brackets were last changed one year ago for tax year 2022, and the tax rates were previously changed in 2017.įederal tax brackets are indexed for inflation, and are updated yearly to reflect changes in cost of living.

0 kommentar(er)

0 kommentar(er)